Each year, Portland Monthly Magazine releases some great information on the 95 different neighborhoods in Metro Portland + the outlying Suburban areas. Here’s the 2018 information. If you’d like more information or a personalized market analysis to find out the current value of your home, please contact me at 503-421-2407 or Phyllis@PointClickandPack.com. The Portland market is still selling very quickly. It’s a good time to be a seller!

Author Archives: admin

Beginning on January 1, 2018, to sell your single family home in Portland, it will become mandatory that you have a home energy score done prior to listing your home on RMLS.

A home energy score provides home owners and buyers comparable and credible information about a home’s energy usage. The score uses the physical characteristics of the house, (size, window types, insulation, roof materials, etc.), and its systems (heating, cooling, etc.) to convey information about what a house’s estimated energy usage is. The score is NOT based on the homeowner’s current energy use, the number of occupants or the types of lighting and appliances present.

Homes are scored on a ten-point scale, with “1” indicating higher energy usage and “10” indicating lower energy usage. Typically, the larger the home is in square footage, the higher the energy score will be, even if the home being assessed uses all of the latest energy-saving devices. It simply takes more energy to heat and cool larger homes. The average Portland home will score a 5.

This standardized scoring system allows buyers to compare different homes on an apples-to-apples basis so long as the homes are comparable in square footage. The assessments show an estimate of the home’s annual energy costs and will also show buyers and sellers where there are opportunities to make energy-reducing improvements. This will help buyers in planning for long-term cost-effective improvements for homes scoring 5 or less.

Currently, only homes located in the City of Portland are required to comply but other cities may follow suit soon. All Counties in Portland are subject to the assessment requirement. The cost of this test is approximately $250 and the test takes about 90 minutes. The assessment and score are available immediately upon testing completion. Condominiums are exempt from testing, as are bank or corporate-owned listings. For newly constructed homes, the Home Energy Performance Report and associated Home Energy Score may be produced based on design documents prior to the construction of the covered building through a Pre-construction Assessment.

Upon completion of a Home Energy Assessment, the home’s report will be publicly disclosed and available at www.greenbuildingregistry.com/portland. Realtors are required to input the score and a copy of the report on the RMLS prior to listing the home. Sellers must ensure that printed copies of the report are available and visible to prospective buyers who view the home while it is listed for sale.

The City of Portland does enforce violations of this code, (City Code Chapter 17.108). Upon determining that a violation has occurred, homeowners may receive a written warning notice describing the violation and the steps required for compliance. If the violation is not remedied within 90 calendar days after the issued written warning, a civil penalty of up to $500 may be assessed. For every subsequent 180 day period during which the violation remains, additional civil penalties of up to $500 may be assessed. Penalties are doled out at the discretion of the City Director.

Homeowners can schedule the assessment online at homescorenow.com. Assessment appointments are typically available within 3-5 days of request. Here’s some more information about what this score entails: https://www.pdxhes.com/about.

Advocacy Update – Courtesy of PMAR (Portland Metro Association of Realtors) Governmental Affairs Director Jane Leo

Portland Public Schools Reviews School Boundaries – All schools up for discussion

PPS is currently in the process of reviewing all school boundaries. We asked Portland Public Schools to provide our members with more details; see the article below for the “why” and “what’s next.” Now more than ever, the information posted in a listing regarding schools can only be “deemed accurate at the time of publication.” If your buyer needs specific information about where their children will go to school or if a boundary will change, they should contact the PPS Enrollment Office at 503-916-3205.

Great Schools for Every PPS Neighborhood Portland Public Schools has a historic opportunity to grow great schools in every neighborhood By Jon Isaacs, Chief of Communications & Public Affairs, Portland Public Schools

In addition to strong and consistent local support for schools and a reviving economy, PPS enrollment is on the rise. Now at 48,500, enrollment is projected to grow by approximately 5,000 students in the next 10 years, returning to levels not seen since the late 1990s.

This growth provides the PPS community an historic opportunity to rebuild programs, reconfigure and right-size schools, while also modernizing school buildings following a decade of declining enrollment and nearly two decades of shrinking program and maintenance budgets.

This is why PPS is currently reviewing all school boundaries, grade configurations, and school building capacities. The decisions that we make as a community and a school district now will serve our children and our city for generations to come.

Why Are We Doing This? Enrollment growth resulting in review of all boundaries

Starting in 1997, PPS enrollment began declining, setting the district on a collision course with the effects of property tax limitation and equalization after several years of spending down the district’s once healthy reserves. In 2002, the annual shortfalls in the PPS budget went from serious to crippling.

To cope, Portland Public Schools took drastic measures. Between 2003 and 2012, the school district closed or consolidated 23 schools. Thirty-two schools experienced boundary change. And, grade configurations were changed at 35 mostly eastside schools, many going from elementary or middle schools to K-8s.

The rationale: consolidate students to allow for sufficient teachers and program offerings at the most schools.

Now, PPS is turning a corner. Portland’s population is growing, and established residents are waiting longer to have children, and are remaining in the city when they do start families. PPS continues to have over 80% of families choosing to send their students to public schools. These factors are driving steady enrollment growth across the school district just as state funding for schools has improved with the economy.

In addition, PPS strengthened neighborhood schools in winter 2015 by ending the use of the lottery system for transfers between neighborhood schools.

The result: an historic opportunity to grow great schools in every neighborhood – for all students.

What Happens Next? Changes beginning Fall 2016

To seize the opportunity we now face across our district, PPS convened a diverse committee of 26 parents, teachers, principals, administrators and technical experts in fall 2014. The committee includes Jane Leo, representing the Portland Metropolitan Association of Realtors®. Since December 2014, the District-Wide Boundary Review Advisory Committee (DBRAC) has been studying district history, demographic trends and the work of similar school districts. DBRAC is advising PPS staff to develop proposals for such future plans to manage growth such as moving boundaries, converting K-8s into elementary and middle schools, expanding existing schools and reopening schools that were closed. Proposals will be released to the community for feedback in mid-October.

The public is invited to learn about and comment on possible changes to schools and boundaries at a series of community meetings in October and November. An online survey and Twitter and Facebook town halls will round out opportunities for comment. Community feedback will shape the final proposals that the committee sends to Superintendent Carole Smith in early December. Superintendent Smith will take a final proposal to the school board in early January 2016. A board decision is expected in time for the school choice period in February. Growth management plans would begin to be implemented in Fall 2016. For up-to-date information on the boundary changes, visit the PPS website at http://www.pps.k12.or.us/departments/enrollment-transfer/9522.htm.

The Oregon Real Estate Sales Contract heavily protects buyers by giving them three standard contingencies, plus an appraisal contingency for financed offers, upon which they can terminate a sale and get a full refund of their earnest money. It’s important to note that once a home is sale pending, the sellers cannot get out of the contract without risking a lawsuit from the buyers for specific performance. Buyers cannot be sued by the seller for specific performance. If a buyer terminates a sale after all of the standard contingencies have been satisfied, then the buyer risks losing his/her earnest money in full as liquidated damages for keeping the seller’s house off the market while waiting for the buyer to perform. Here are the basics of each contingency:

The Seller’s Property Disclosure – 5 Business Days After Receipt of this Document

Prior to listing their home for sale, sellers fill out a five page property disclosure which lists everything they know about their home in check box format. (Ex: Has the roof leaked? Yes or No. If so, has the leak been fixed? Yes or No). Buyers have five business days after receipt of this disclosure to back out of the transaction for any reason (or no reason) whatsoever. This is the buyer’s right of revocation under OR law. If the seller (typically via the listing agent) does not provide the property disclosure until closing, then the buyers can back out of the purchase, keeping their earnest money, up until closing. Normally though, the disclosure is provided to buyers upon offer acceptance, so this contingency is satisfied within the first five business days of offer acceptance. In my experience, buyers rarely terminate a transaction based on information learned from the property disclosure. If they terminate on disclosure, it’s usually because they have found another home they want to buy instead, or have gotten cold feet about the purchase for some other reason. However, the property disclosure is the first place buyers check when problems arise during the transaction or after closing. And non-disclosure about issues that can be somehow proven that the sellers were aware of but didn’t reveal can lead to lawsuits. For this reason, it is imperative that sellers reveal everything they know about the home, during the time that they’ve lived in the home, on this form.

Home Inspection – 7-10 Business Days After Offer Acceptance

Buyers have the right to have the home inspected unless they specifically waive this right in the contract. The time frame for inspections is most typically 7 or 10 business days after an offer has been accepted. Business days begin the next day. Ex: If an offer is accepted at 8:00 am Monday, the time frame for all contingencies would begin on Tuesday. Additionally, unless stated otherwise, the deadline for all contingencies is 5:00 pm on the final day. Once the buyers have obtained all desired inspections, they have three options: (1) Remove the inspection contingency and proceed to closing without asking the seller for any repairs; (2) Unconditionally disapprove of the inspection and terminate the sale; (3) Write up a repair addendum asking the sellers to make repairs and/or reduce the sales price (or provide a credit towards closing costs) in lieu of repairs. If agreement is not reached on the repair addendum, the buyers have the right to terminate the sale. The sellers do not have the right to terminate. However, they can refuse to do any repairs or provide any closing cost credits or price reductions. They could simply revert back to the original accepted offer and perform accordingly. (Please see my other Blog article about the types of inspections available).

Preliminary Title Report – 5 Business Days for Escrow to Send, and then 5 Business Days for Buyer Review

The preliminary title report (prelim) is generated by the escrow company and is emailed out to all parties in the transaction within five business days of the opening of escrow. This is most typically effectuated within 1-2 business days after offer acceptance and is handled by one or both of the realtors involved in the sale. The prelim shows all of the following information (and more): Liens against the home; Easements affecting the property; Judgments against the buyers and sellers (child support/alimony/court judgments); Taxes due or paid; Codes, Covenants & Restrictions, (CCR’s) and Bylaws for condominium and townhouse complexes; Legal property description; Filed litigation affecting the property, etc. Once the buyers receive the prelim, they have five business days to challenge it. Unlike the property disclosure where the buyer does not need a reason to terminate, if the buyer wants to terminate based on the information learned from the prelim, they must have a reason for doing so and this reason must be one that the seller cannot or will not agree to remedy. For example, if there is a contractor lien on the property and the sellers agree to pay the lien at closing, then this item is considered satisfied and the buyers cannot terminate for this reason. If the sellers do not agree to pay the lien and the buyer does not want to pay it, then the buyers can terminate the sale and get their earnest money back. An example of an issue that the seller would not be able to remedy would be any item featured in the CCR’s for the complex or neighborhood. If the complex does not allow dogs, the seller will not be able to change that issue, so the buyer can choose to terminate at this point if they want to keep their dogs. Utility company or fire hydrant easements are not considered to be valid reasons for termination. Nor would any item that would have been easily recognized or already disclosed prior to offer acceptance (ex: a shared driveway).

Appraisal Contingency

For buyers obtaining a loan to make their purchase, the lender will require a property appraisal. The appraisal is typically the final step in the sales transaction. This report is normally ordered after the inspection contingency has been satisfied. For conventional or FHA loans, it takes approximately 2 1/2 weeks from the date ordered for the appraiser to schedule the appraisal visit, complete the home valuation report and submit it to the lender. VA loans take about 2 weeks longer. If the home appraises at or above the sales price, then the sale moves forward to closing. If the appraisal price comes in below the sales price, then the buyer and seller have the following options; (1) Challenge the appraisal by sending in different comps or disputing information in the original appraisal report in hopes that the appraiser will increase the appraised value to the sales price or higher; (2) The seller can agree to lower the sales price to the appraised value and the sale will continue at the lower price; (3) The buyers can bring in the difference in the appraised value and sales price in addition to their original down payment. For example, if the sales price is $250k but the appraisal comes in at $240k, the buyers can choose to continue with the transaction by bringing in another $10k at closing on top of the down payment needed to fund their loan. If the above options lead to a stalemate by the parties and the appraiser is unwilling or unable to adjust his/her value to meet the original sales price, then the buyers can terminate and get their earnest money refunded.

One final note: Other than the appraisal contingency, the three main contingencies typically run concurrently within 10 business days of offer acceptance. Thus, if buyers want to terminate within the first 10 business days, usually they can get a full refund of their earnest money. However, once all contingencies have been satisfied and the appraisal has come in at or above sales price, then terminating buyers typically forfeit their earnest money to the sellers.

Feel free to contact me with questions about the Sales Contract. You can reach me at Phyllis@PointClickandPack.com or 503-421-2407. I look forward to hearing from you!

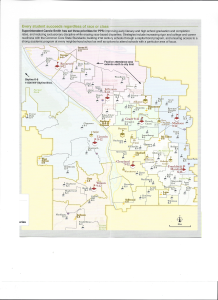

Here’s an excellent map of where all 78 schools in the Portland Public School District are located. Kindergarten thru High School are included. PPS offers language immersion programs in grades K-8 in Spanish, Chinese, Vietnamese, Russian & Japanese, as well as focus schools which specialize in areas such as science or the arts. Both of my kids are in the Spanish immersion program and were fluent in Spanish by 2nd grade! Contact me if you’d like more information, 503-421-2407.

Here’s an excellent map of where all 78 schools in the Portland Public School District are located. Kindergarten thru High School are included. PPS offers language immersion programs in grades K-8 in Spanish, Chinese, Vietnamese, Russian & Japanese, as well as focus schools which specialize in areas such as science or the arts. Both of my kids are in the Spanish immersion program and were fluent in Spanish by 2nd grade! Contact me if you’d like more information, 503-421-2407.

One of the newest trends in Portland is the Microhouse. Here’s a funny, but accurate, view of the inside of one. In Portland, we’re seeing Microhousing being used as a both an ADU and as a way of life/condo alternative.

Here’s a great reference for how Portland’s 95 different neighborhoods got named. If you’d like a boundary map of these neighborhoods, please call me, 503-421-2407, or send me an email request, Phyllis@PointClickandPack.com.

The National Association of Realtors just released their 2015 Profile of Home Staging. This report shows the statistics on whether staging influences a buyer’s decision to purchase. Key findings were that:

* 81% of buyers thought that it was easier to visualize a staged property as a future home.

* 46% of buyers were more willing to tour a home that had been staged that they viewed online first.

* 45% of buyers said that a home staged to their tastes positively impacted the home’s value. Whereas, if the home was not staged to the buyer’s tastes, then 10% of buyers said that the staging negatively affected the home’s value.

* 28% of buyers were willing to overlook other property faults in a staged home.

* 5% of buyers said that staging made them more suspect of the home’s features.

For sellers, the most important rooms to be staged, in order of importance are: Living Room, Kitchen, Master Bedroom, Dining Room, Bathroom, Children’s Bedrooms and Guest Bedroom.

Personally, I think staging a home is a good idea, especially for homes with odd room sizes or rooms/spaces that don’t have a particular purpose. Also, staged homes show better than vacant properties and allows buyers to see how furniture fits best in each room.

Call me today for more information about marketing your home to sell quickly, 503-421-2407. I look forward to assisting with your sale!

Seller paid closing costs are basically a paper transaction. There are costs for the buyer for getting a loan. These include origination fees, loan processing fees, escrow fees & recording fees. Your lender can send you a break-down of these costs if you don’t already have a copy. In addition, your loan could include an escrow account to pay your taxes and insurance with your mortgage payment. If you choose to have an escrow account then there are typically 6-12 months worth of padding to set up this account initially and these reserve funds are collected by your escrow officer at closing. Think of your escrow account as simply a bank account for the house. When you sell, you will be refunded any unused portion in the account. But during your ownership, your bank will take care of your property tax payments and home insurance payments each year. (They pad the account at the onset so that they don’t need to ask each buyer for more money when taxes and insurance rates go up each year). These reserve funds to set up your escrow account are called “pre-paids.” In loans where the buyers have a 20% down payment or more, the buyers can choose to pay their own taxes and insurance each year, in which case they would not have pre-paids. When you close, you will need to provide the balance of your down payment (your earnest money deposit goes towards your down payment) plus your closing costs and pre-paids. When the seller agrees to pay a portion of these, (let’s say $5,000 just to have a number), then that simply shows up as a credit on your closing statement. So at closing, you will need to bring $5k LESS to the closing table while the seller nets $5k LESS from his profit. This is why it’s a paper transaction, because neither party actually shows up with this money at closing. Let’s say you want to pay your own taxes and insurance, and therefore you don’t have pre-paids, and your closing costs come to $3k. You would then talk to your lender about buying down your interest rate so that you come up with another $2k in closing costs and thus have a less expensive mortgage payment. Or, you would ask the seller to do $2k worth of repairs prior to closing and then contribute $3k towards your closing costs. Any unused portion of closing costs gets credited back to the seller, so it’s important to know exactly how much your loan needs in costs before negotiating this as part of the transaction. The closing cost contribution has absolutely NOTHING to do with the seller’s costs to close. The seller will have some closing costs related to escrow and recording fees, but they pale in comparison to loan costs and these show up as a debit on the seller’s closing statement meaning that the seller’s profit is reduced by that amount. Please contact me if you want additional information. You can reach me at Phyllis@PointClickandPack.com or 503-421-2407.

Whether you are new to the Portland area or a local resident, searching for a home can be a tedious task. With over 95 different neighborhoods in the Portland Metro area, deciding where to buy a home or how much a home is worth can be confusing. It is my goal to make your purchase as easy and enjoyable as possible. If you’re new to the area, let me be the first to welcome you to Portland. It will be my pleasure to assist you with all of your real estate needs!

To begin, let me give you a basic idea of the lay of the land. The Portland Metro area consists of 95 different neighborhoods. Most of these neighborhoods have their own park and/or shop and restaurant district. The neighborhoods are divided into 5 sections: North, Northeast, Southeast, Northwest and Southwest.

The east and west sides of the city are divided by the Willamette River. Once you’ve visited here, you’ll understand why one of Portland’s nicknames is the City of Bridges. Each time you cross a bridge, you’ve crossed into either the east side or the west side. The north and south sides of the city are divided by Burnside Street. Burnside is neither north nor south. You will either be on East Burnside or West Burnside depending upon which side of the Willamette you are standing.

As a rule, the east side of Portland is geographically fairly flat and the west side is hilly. The east side is also easier to navigate than the west side because it is mostly set up in a grid pattern. Imagine the Willamette River as being labeled “0 Street.” Almost all streets running parallel to the Willamette (and are thus going in the north/south direction) are numbered. So SE 50th Ave is 50 blocks east of the Willamette River (and also downtown Portland since the downtown district begins immediately on the west side of the river). When you hear neighborhoods being described as “close-in,” this means close-in to downtown Portland. Locals typically think of all homes located west of 82nd Ave as being close-in.

As previously mentioned, the west side is geographically more hilly. Streets tend to dead-end (sometimes for no apparent reason) or curve into other streets. The west side is much more difficult to learn because of these issues.

<h3>Real Estate – East Side vs West Side<h3>

Generally speaking, homes located on flat ground are usually less expensive than homes that are on hillsides. This means that the east side is typically more affordable than the west. Keep in mind though that there are some very pricey neighborhoods on the east side and some fairly affordable neighborhoods on the west despite the geographical factors.

The standard lot size on the east side is 50’ x 100’ or 5,000 sf rectangular lots. Lots on the west side are usually larger, around 6,000 – 8,000 sf, and tend to be irregularly shaped. The larger lot sizes on the west side contribute to the higher prices of homes in this area.

The east side was primarily built from 1910 – 1940’s and home styles tend to include Bungalows, Cape Cods, Old-Portlands (covered front porch and steps leading upstairs that are visible as soon as you enter), Victorians and Traditionals. The west side (other than downtown Portland) was developed in the late 1940’s – 1980’s. Home styles tend to consist of the Ranch, Dayranch (looks like a ranch from the front but sits on a hillside, so from the back, it looks like a 2-story), Split-level and Contemporary. North Portland was the site of the first development and has the smallest and oldest homes. Home styles are similar to those mentioned for east side properties. Due to their small size and age/condition, real estate is typically most affordable here. North Portland is currently experiencing a great deal of gentrification and revitalization and many investors see this area as prime property for flips (purchasing fixer-uppers, renovating them and then reselling for a profit).

Almost all of Metro Portland has an urban feel to it with the exception of some neighborhoods in SW. Most neighborhoods on the east side have sidewalks throughout and are very pedestrian and bike-friendly. Many of the neighborhoods on the west side lack sidewalks and tend to be a bit more difficult for pedestrians and bike riders because of the hills and traffic patterns. Despite these factors, many SW neighborhoods have a somewhat more suburban feel to them.

If suburban living appeals to you, this can be found in the immediate outlying cities of Beaverton, Tigard, Tualatin, Hillsboro, Sherwood, Lake Oswego, West Linn, Wilsonville and Gresham. I would be happy to help you find property in all of those cities if they would fit your needs better than Metro Portland and I can provide you with more details of those cities should you choose to want that information.

<h3>Shops and Restaurants and Arts District</h3>

Metro Portland consists of mostly mom & pop shops and restaurants. People who live in the close-in neighborhoods tend to gravitate towards local businesses and artists. There are some pockets of corporate big-box retailers and fast-food restaurants, but these areas are few and far between. There are 2 shopping malls located close-in. Pioneer Place Mall is in the heart of downtown Portland, and Lloyd Center is just east of the Willamette River. Lloyd Center has a large ice-skating rink as its center court. The department stores at these malls are Meier & Frank, Sears, Nordstrom and Saks Fifth Ave. The suburban outlying cities mostly consist of corporate retailers and restaurants and have very few locally owned businesses or artist galleries.

The majority of our fine arts district, including the Oregon Symphony and the Center for the Arts, is in downtown Portland. Most rock concerts and our NBA basketball team, the Portland Trailblazers, play at the Rose Quarter stadium, which is located in the Lloyd Center district just east of downtown Portland.

Again, I appreciate the opportunity to work with you on your home purchase. Please let me know how I can best assist with all of your real estate needs!